-

Contact Us

-

General Inquiries/Service Requests:

- 888.313.6862

-

contactcenter@oncor.com

-

(Mon.-Fri., 8 a.m.-6 p.m. Central Time)

-

For Outages

- 888.313.4747

-

(24/7)

NEWS RELEASE

For additional information, contact:

Oncor Communications: 877.426.1616

Oncor Investor Relations: 214.486.6035

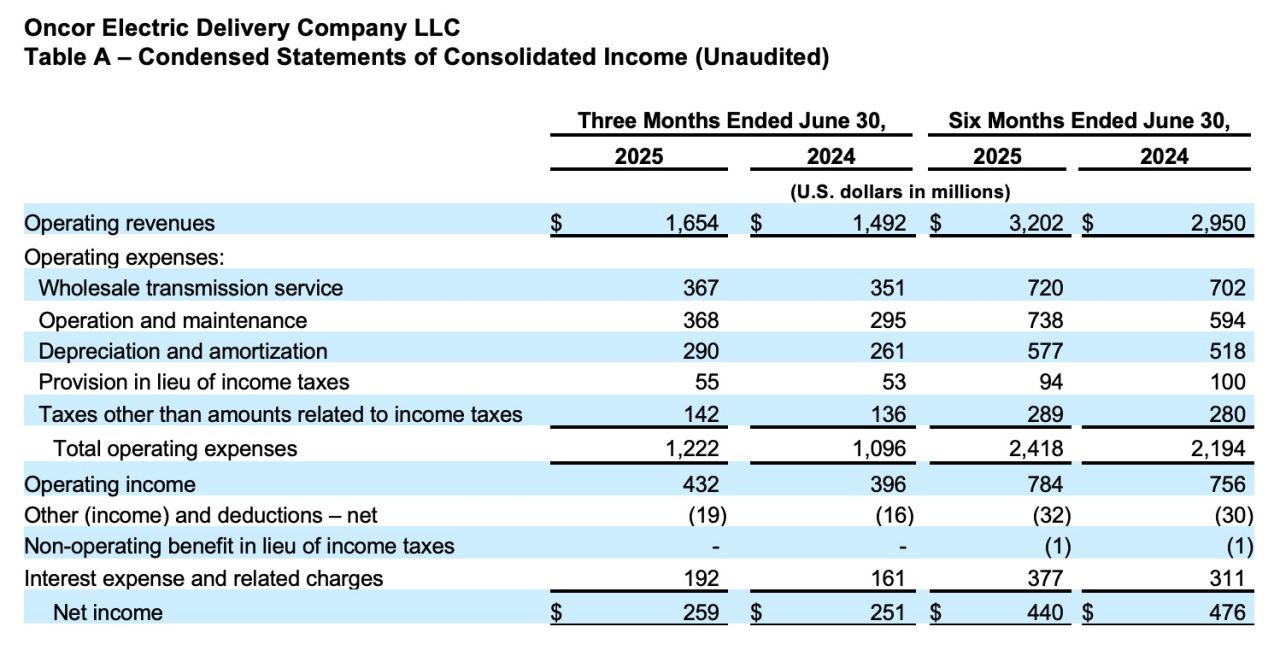

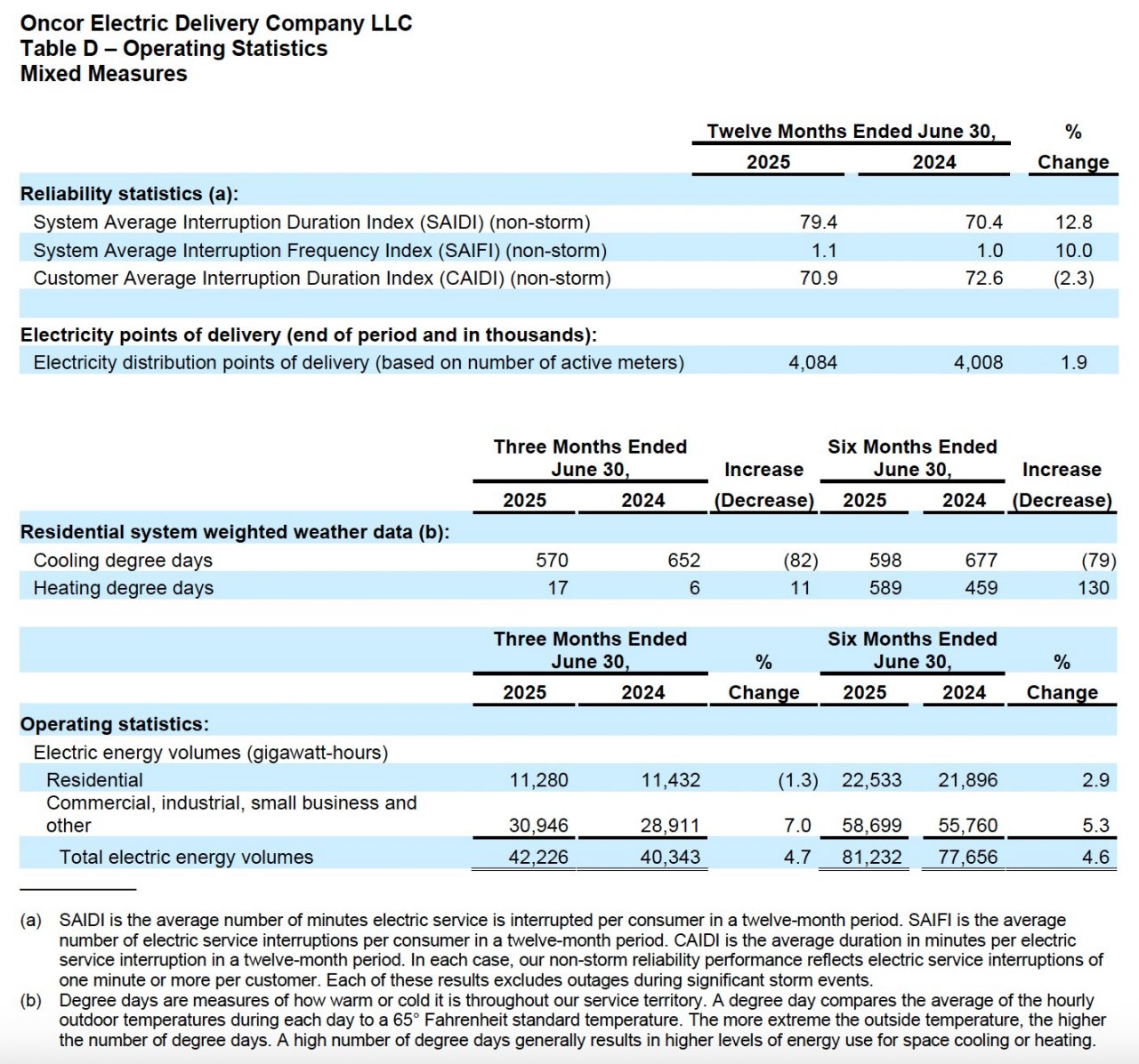

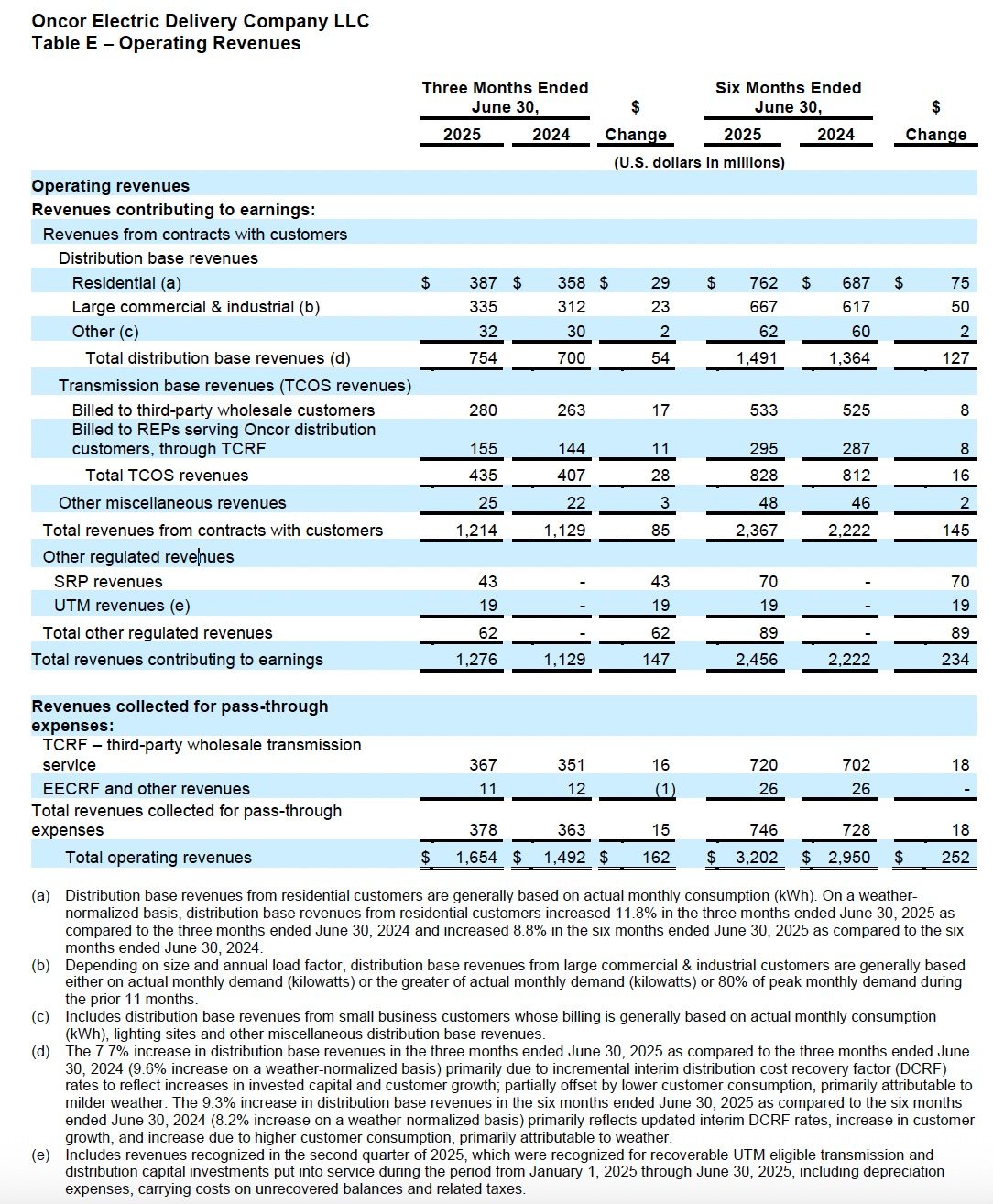

DALLAS (August 7, 2025) — Oncor Electric Delivery Company LLC (Oncor) today reported net income of $259 million for the three months ended June 30, 2025, compared to net income of $251 million in the three months ended June 30, 2024. The increase in net income of $8 million was driven by overall higher revenues primarily attributable to updated interim rates to reflect increases in invested capital, an increase in other regulated revenues recognized related to Oncor’s system resiliency plan (SRP) and the unified tracker mechanism (UTM) established by Texas House Bill 5247, and customer growth, partially offset by higher interest expense and depreciation expense associated with increases in invested capital, and higher operation and maintenance expense. Financial and operational results are provided in Tables A, B, C, D, and E below.

“As we move through the peak summer season, our team remains steadfast in its commitment to safely delivering reliable power to the more than 13 million Texans we serve,” said Oncor CEO Allen Nye. “We work year-round to strengthen and modernize our system to meet the growing demands across our expanding service territory. This past quarter, Oncor filed a rate case to recover historical storm-related costs, support the recruitment, training, and safety of our large and active workforce, and secure materials and equipment at an unprecedented scale. A constructive outcome, combined with supportive legislation passed during the 89th Texas Legislature, will enhance our financial strength and position Oncor to raise the capital necessary to serve our customers and the State during this period of exceptional growth in Texas.”

Oncor also reported net income of $440 million for the six months ended June 30, 2025, compared to net income of $476 million in the six months ended June 30, 2024. The decrease in net income of $36 million was driven by higher interest expense and depreciation expense associated with increases in invested capital and higher operation and maintenance expense, partially offset by overall higher revenues primarily attributable to updated interim rates to reflect increases in invested capital, customer growth, an increase in other regulated revenues recognized related to the SRP and the establishment of the UTM, and higher customer consumption primarily attributable to weather.

Operational Highlights

During the second quarter, Oncor continued work on its company record $7.1 billion annual capital expenditure plan for 2025. Key operational updates during the second quarter included implementation of important components of Oncor’s SRP, such as, enhanced wildfire risk modeling, completion of approximately 2,000 miles of resiliency assessments (primarily in wildfire mitigation zones), and the acquisition of approximately 20,000 miles of LiDAR data and 2,800 miles of drone imagery.

Additionally, Oncor’s team has been hard at work on planning and other pre-construction work related to the 765 kV Electric Reliability Council of Texas, Inc. (ERCOT) Strategic Transmission Expansion Plan (STEP), including Oncor’s import lines in the Permian Basin Reliability Plan (PBRP), and submitting the remainder of the 765 kV Eastern portion of STEP to the ERCOT Regional Planning Group in conjunction with other utilities. The joint filings for the Eastern portion of STEP outline approximately $10 billion of projects. The joint filings did not address the remaining lower voltage transmission system upgrades and new transmission facilities needed, which ERCOT estimates will have a cost of $8 – $10 billion. Oncor anticipates it will be responsible for building a significant amount of the total Eastern portion of STEP. During the quarter Oncor filed four new Certificates of Convenience and Necessity (CCNs) for needed transmission projects building on the seven CCNs filed in the first quarter of 2025. Four previously filed projects also received regulatory approvals in the second quarter, clearing the way for new substations and line upgrades to proceed.

In the second quarter of 2025, Oncor built, rebuilt, or upgraded approximately 590 circuit miles of transmission and distribution lines and increased premises by nearly 20,000, reflecting ongoing population and business growth in Texas. Active transmission point-of-interconnection (POI) requests continued to rise in the second quarter, remaining well above year-ago levels. As of June 30, 2025, Oncor’s active large commercial and industrial (LC&I) interconnection queue was approximately 38% higher than at the same time last year. As of June 30, 2025, Oncor’s active LC&I interconnection queue had 552 requests, which includes approximately 186 gigawatts from data centers and over 19 gigawatts of load from diverse industrial sectors demonstrating broad-based industrial growth within Oncor’s service territory. Of the 570 active generation POI requests in queue at June 30, 2025, approximately 49% were storage, 40% were solar, 7% were wind, and 4% were gas.

Oncor is currently in the process of updating its annual capital plan, including assessing the impact of accelerated timelines for critical transmission infrastructure and system upgrades. The company previously announced a $36.1 billion capital plan for the 2025–2029 period and now anticipates that incremental capital expenditures over that timeframe could exceed $12 billion, particularly in the later years of the plan.

Oncor expects to present an initial view of its new five-year capital plan for 2026–2030 to its Board of Directors in October, with a public announcement of the final updated plan anticipated in the first quarter of 2026.

Legislative Outcomes

The Texas Legislature concluded its regular session on June 2, 2025, with several key legislative outcomes that Oncor believes will positively impact the company and its customers. In particular, Oncor believes Texas House Bill 5247 provides benefits to many of its stakeholders. This bill allows qualifying electric utilities such as Oncor to record costs to a regulatory asset arising from eligible capital investment and apply for interim rate adjustments through an annual UTM filing. The UTM is expected to benefit residential customers by ensuring that new large load customers coming to the Oncor system have costs allocated to them appropriately. The UTM also provides deadlines for the timely completion of PBRP and, by combining six annual filings into one as well as extending the deadline for review by the Public Utility of Commission of Texas (PUCT), should reduce the workload for the PUCT.

Oncor plans to make its first UTM filing in the first half of 2026, after the completion of its rate case. In the meantime, Oncor has begun recognizing revenues associated with qualifying investments for eligible transmission and distribution infrastructure placed in service after December 31, 2024.

The Texas Legislature also passed several new laws and approved significant funding to reduce the risks of wildfires and better prepare the state and local governments to rapidly respond to a wildfire, including a requirement in Texas House Bill 145 that utilities file a wildfire mitigation plan with the PUCT. The PUCT has initiated a rule-making to implement Texas House Bill 145, and Oncor plans to submit its wildfire mitigation plan for approval upon the completion of the PUCT’s rule-making.

Regulatory Update

On June 26, 2025, Oncor filed a comprehensive base rate review request with the PUCT and the 210 cities in its service territory that have retained original jurisdiction over rates to adjust electric delivery rates (PUCT Docket No. 58306). The primary drivers of the rate increase requested in the filing are increased storm restoration expenses, rising material and labor costs, higher insurance premiums, and other inflationary pressures experienced by Oncor since 2021, the historical test year of its last rate review, as well as modifications to support Oncor’s ongoing capital investment program and maintain reliable service amid rapid customer and infrastructure growth. Oncor expects a regulatory decision in the first quarter of 2026. On July 8, 2025, Oncor filed a request for a partial interim adjustment of rates to begin to recover some of the increased costs while the case is pending, subject to refund or surcharge to the extent the interim rates differ from the final rates approved by the PUCT.

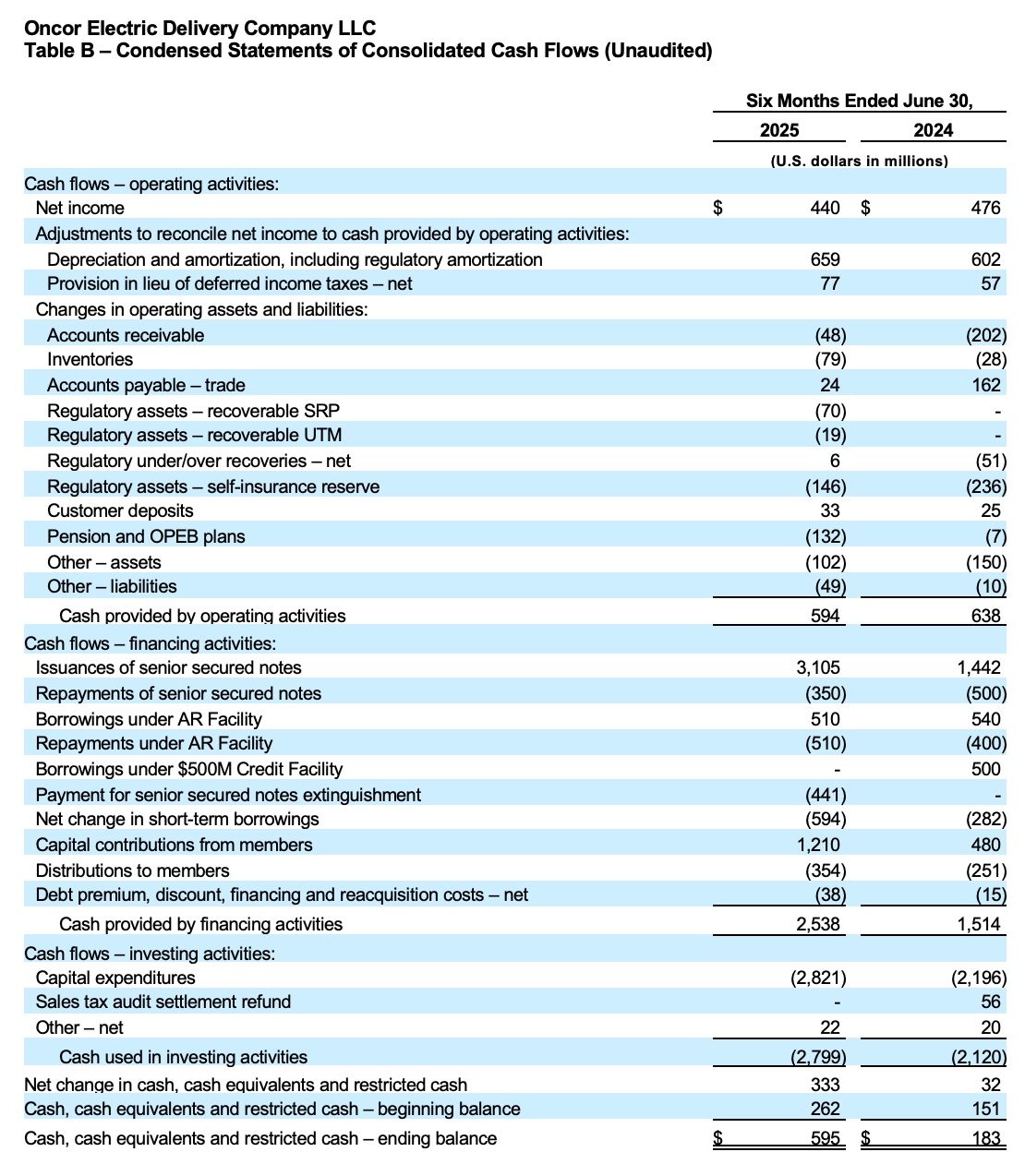

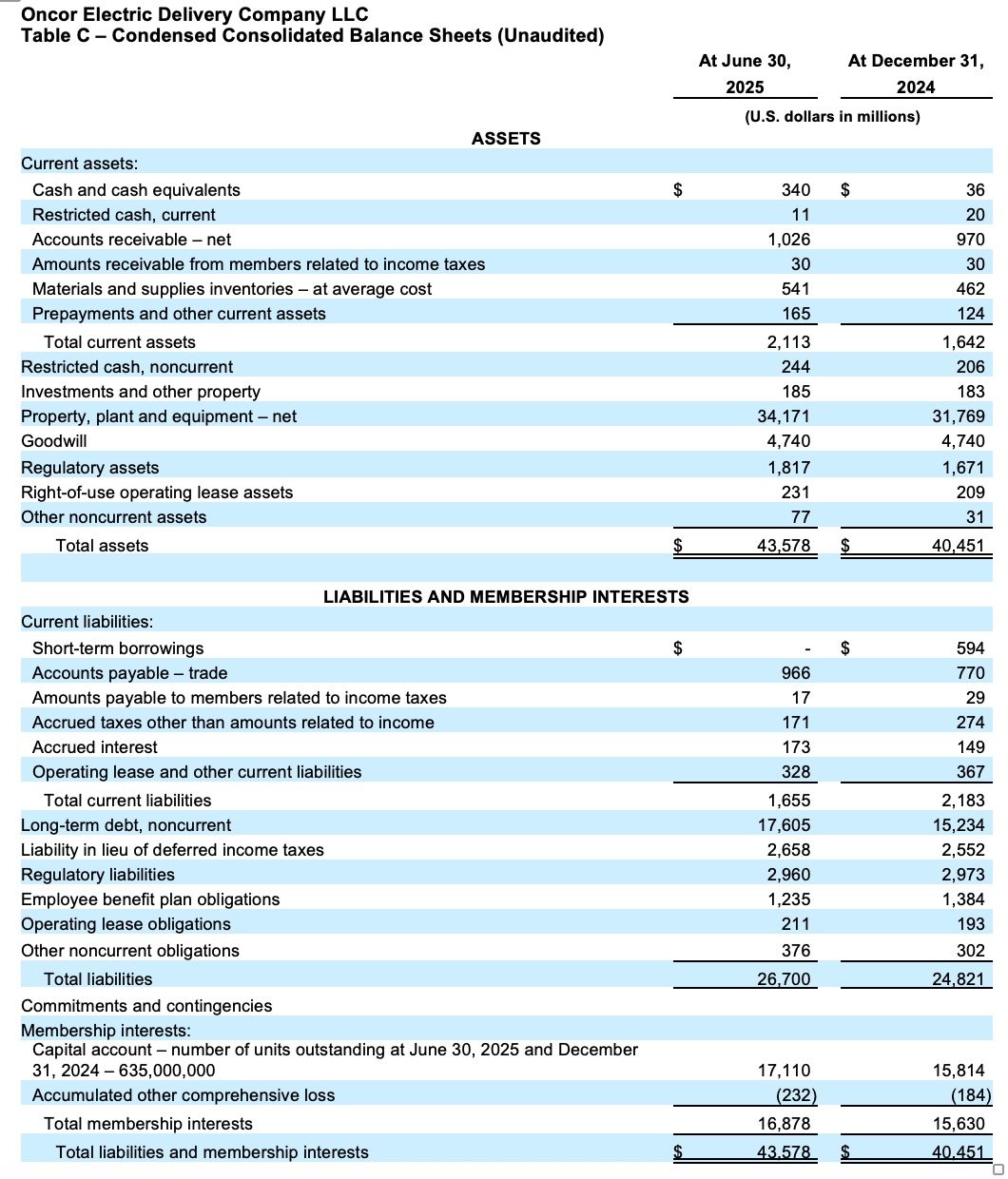

Liquidity and Credit Update

As of August 6, 2025, Oncor’s available liquidity totaled approximately $3.9 billion, consisting of cash on hand and available borrowing capacity under its credit facilities, commercial paper programs, and accounts receivable facility. Oncor anticipates these resources, combined with projected cash flows from operations and future financing activities, will be sufficient to meet capital expenditures, maturities of long-term debt, and other operational needs for at least the next twelve months.

On July 29, 2025, S&P Global Ratings (S&P) downgraded Oncor’s issuer credit rating from “A“ to “A-,” citing elevated wildfire risk as a result of changing climate conditions and the absence of liability caps or affirmative legal defenses in Texas. S&P also revised Oncor’s outlook from “negative” to “stable.” In its press release, S&P noted that it expects Oncor’s financial measures to benefit from ratemaking changes implemented under Texas House Bill 5247. S&P also noted that its base case assumes that Oncor receives a constructive rate case order.

Sempra Internet Broadcast Today

Sempra (NYSE: SRE) will broadcast a live discussion of its earnings results over the Internet today at 12 p.m. ET, which will include discussion of second quarter 2025 results and other information relating to Oncor. Oncor executives will also participate in the broadcast. Access to the broadcast is available by logging onto the Investors section of Sempra’s website, sempra.com/investors. Prior to the conference call, an accompanying slide presentation will be posted on sempra.com/investors. For those unable to participate in the live webcast, it will be available on replay a few hours after its conclusion at sempra.com/investors.

Quarterly Report on Form 10-Q

Oncor’s Quarterly Report on Form 10-Q for the period ended June 30, 2025 will be filed with the U.S. Securities and Exchange Commission after Sempra’s conference call and once filed, will be available on Oncor’s website, oncor.com.

About Oncor

Headquartered in Dallas, Oncor Electric Delivery Company LLC is a regulated electricity transmission and distribution business that uses superior asset management skills to provide reliable electricity delivery to consumers. Oncor (together with its subsidiaries) operates the largest transmission and distribution system in Texas, delivering electricity to more than 4 million homes and businesses and operating more than 144,000 circuit miles of transmission and distribution lines in Texas. While Oncor is owned by two investors (indirect majority owner, Sempra, and minority owner, Texas Transmission Investment LLC), Oncor is managed by its Board of Directors, which is comprised of a majority of disinterested directors.

Forward-Looking Statements

This news release contains forward-looking statements relating to Oncor within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. All statements, other than statements of historical facts, that are included in this news release, as well as statements made in presentations, in response to questions or otherwise, that address activities, events or developments that Oncor expects or anticipates to occur in the future, including such matters as projections, capital allocation, future capital expenditures, business strategy, competitive strengths, goals, future acquisitions or dispositions, development or operation of facilities, market and industry developments and the growth of Oncor’s business and operations (often, but not always, through the use of words or phrases such as “intends,” “plans,” “will likely result,” “expects,” “is expected to,” “will continue,” “is anticipated,” “estimated,” “forecast,” “should,” “projection,” “target,” “goal,” “objective” and “outlook”), are forward-looking statements. Although Oncor believes that in making any such forward-looking statement its expectations are based on reasonable assumptions, any such forward-looking statement involves risks, uncertainties and assumptions. Factors that could cause Oncor’s actual results to differ materially from those projected in such forward-looking statements include: legislation, governmental policies and orders, and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena, including severe weather events, natural disasters or wildfires; cyber-attacks on Oncor or Oncor’s third-party vendors; changes in expected ERCOT and service territory growth; changes in, or cancellations of, anticipated projects, including customer requested interconnection projects; physical attacks on Oncor’s system, acts of sabotage, wars, terrorist activities, wildfires, fires, explosions, natural disasters, hazards customary to the industry, or other emergency events; Oncor’s ability to obtain adequate insurance on reasonable terms and the possibility that it may not have adequate insurance to cover all losses incurred by Oncor or third-party liabilities; adverse actions by credit rating agencies; health epidemics and pandemics, including their impact on Oncor’s business and the economy in general; interrupted or degraded service on key technology platforms, facilities failures, or equipment interruptions; economic conditions, including the impact of a recessionary environment, inflation, foreign policy, and global trade restrictions; supply chain disruptions, including as a result of tariffs, global trade disruptions, competition for goods and services, and service provider availability; unanticipated changes in electricity demand in ERCOT or Oncor’s service territory; ERCOT grid needs and ERCOT market conditions, including insufficient electricity generation within the ERCOT market or disruptions at power generation facilities that supply power within the ERCOT market; changes in business strategy, development plans or vendor relationships; changes in interest rates, foreign currency exchange rates, or rates of inflation; significant changes in operating expenses, liquidity needs and/or capital expenditures; inability of various counterparties to meet their financial and other obligations to Oncor, including failure of counterparties to timely perform under agreements; general industry and ERCOT trends; significant decreases in demand or consumption of electricity delivered by Oncor, including as a result of increased consumer use of third-party distributed energy resources or other technologies; changes in technology used by and services offered by Oncor; changes in employee and contractor labor availability and cost; significant changes in Oncor’s relationship with its employees, and the potential adverse effects if labor disputes or grievances were to occur; changes in assumptions used to estimate costs of providing employee benefits, including pension and other postretirement employee benefits, and future funding requirements related thereto; significant changes in accounting policies or critical accounting estimates material to Oncor; commercial bank and financial market conditions, macroeconomic conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds and the potential impact of any disruptions in U.S. or foreign capital and credit markets; financial market volatility and the impact of volatile financial markets on investments, including investments held by Oncor’s pension and other postretirement employee benefit plans; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; Oncor’s adoption and deployment of artificial intelligence; financial and other restrictions under Oncor’s debt agreements; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; and Oncor’s ability to effectively execute its operational and financing strategy.

Further discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor with the U.S. Securities and Exchange Commission. Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. Any forward-looking statement speaks only as of the date on which it is made, and, except as may be required by law, Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for Oncor to predict all of them; nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. As such, you should not unduly rely on such forward-looking statements.

None of the website references in this press release are active hyperlinks, and the information contained on, or that can be accessed through, any such website is not, and shall not be deemed to be, part of this document.